Implications for the USD A 5% - 10% correction against the dollar, translates into a USD move to 81 and then 85. Which therefore is supportive of the dollar at least in terms of dollar yen, as I don't see it happening in terms of the USD index. However an imminent Yen correction implies that the dollar could experience a lift in the near future towards 80 before year end, beyond that it is not clear as the Yen could base at 116 before setting itself up for a new all time high against the dollar i.e break above 123 i.e. suggesting dollar strength into End 2010 and then weakness into mid 2011, which roughly matches Euro expectations, though out of sync with GBP.

Who is Winning the Currency War ?

The mainstream press has belatedly woken up to the fact that all exporting countries are vying to devalue their currencies against the primary destination for all junk goods, the United States. Without repeating what I wrote at length in last weeks analysis (04 Oct 2010 - British Pound Sterling GBP Currency Trend Forecast into Mid 2011 ), clearly the above pairs show that the currency war is definitely not being won by Japan, though the Germans appear to be prospering from the bankrupting PIGS to some extent, so who is actually winning the 'currency war' ?

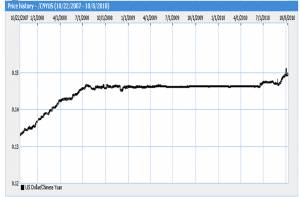

Dollar / Yuan

Saving the best till last as China is the master currency manipulator as evidenced by the flat lining graph over the past 2.5 years. Which illustrates the degree to which China manipulates its exchange rate against the U.S. Dollar. The Dollar / Yuan trend is highly political where the Chinese only respond to political pressure in terms of letting the Yuan appreciate

Pressure is building in the U.S. for action on the Yuan / Dollar peg which if it follows the last major revaluation suggests that the recent rally may just mark the starting point for a major but gradual revaluation of the exchange rate over the next 2 years to a level that will be followed by several more years of a highly managed fixed rate to again eventually result in political pressure on China to revalue once more.

Implications for the USD

The Yuan is not part of the USD Index which on face value suggests that it should not have a significant impact. However to push the Yuan lower against the dollar the Chinese will be selling Dollars (or buy less dollars) for Yuan thus increasing the supply of dollars and thus pushing the dollar lower against all currencies which I anticipate will be at least a year long trend of extra downward pressure on the US Dollar. The implications are for the USD to trend lower over the coming year to a NEW USD low much as transpired during the last revaluation.

China Winning the Currency War

All of the above mentioned countries consistently run huge trade surpluses against the US Dollar, which should in a free floating (falling) currency market result in a greater rate of descent for the US Dollar as a consequence of the trade imbalances, but especially China is refusing to allow these imbalances to correct themselves, instead China sees primarily the US Consumers (Mall Zombies) as a prime driver for China's economic growth even if it means they ultimately suffer huge losses on their $2.5 trillion of reserves, which given the big picture is a small price to pay for Chinese GDP doubling approximately every 8 years to now stand at $5 trillion annually. Therefore China has been winning the currency war for a decade and is now expanding its operations to force competitors such as Japan out of business by FORCING the Japanese Yen higher, which is why Japan and other western nations are preparing to dump huge amounts of their currencies on the market in an attempt to counter Chinese actions. China's strategy is for a gradual revaluation to both sooth Washington and allow its exporters to adjust to the gradual currency appreciation which means there won't be much impact on the trade deficit, unless China starts to import U.S. goods and services.

Meanwhile American workers are deluding themselves into believing that they deserve to be paid ten times Chinese and other asian workers for performing similar servicing or manufacturing jobs. The bottom line is that the U.S. is highly uncompetitive in terms of worker productivity where even a currency crash of 50% would not make much difference. In my opinion there is absolutely nothing that the US can do but to go through the painful process of making their workers more productive after having been on a debt binge for the past 30years that financed living standards. The government / Feds only answer is to print money, they do not have any other answer as the politicians cannot engage in policies of severe austerity, far greater than that which Greece is suffering that will effectively have the voters throw them out of office, therefore the money printing debt monetization trend of the giant debt and liabilities mountain that some say stands at $200 trillion, which is far beyond the official tally of $13 trillion which ridiculously under estimates the true level of US debt. For instance the nationalisation of Fannie and Freddie alone added $10 trillion of liabilities, effectively doubling the US national debt at the time. The debt monetization trend will continue for the next decade if not longer as INFLATION (take note delusional deflationists) will be the prime mechanism that eats away at the debt mountain and purchasing power of US wages so that they converge in terms of real competitiveness with the rest of the world.

The Cold War Trade Deficit Policy

The manifestation for this lack of competitiveness is the trade deficit. It is NOT the fault of the Chinese that the trade deficit exists, it is the fault of the US consumers who BUY CHINESE and JAPANESE JUNK! This is as consequence of the policy of successive US Governments dating back to the midst's of the cold war era when the United States used the Dollar as a global reserve currency weapon against the Soviet Union to exert control over other nations through currency and trade and to achieve this meant that the U.S. was required to operate a trade deficit so as to advance the U.S. centric global financial system that succeeded in squeezing the financial life out of the Soviet Union as its currency collapsed. The only problem is that the U.S. and the rest of the world had become so drunk on the U.S. perpetual trade deficit policy that instead of correcting this following the collapse of the Soviet Union i.e. by reducing the dollars reserve currency role, it just continued as the U.S. imported Deflation in consumer goods and services from Asia in exchange for mountains of U.S. Dollars that reinforced the dollars hold over the global financial system but only upto the point where the U.S. were able to maintain the value of the U.S. Dollar.

Today we have near zero US interest rates whilst at the same time the trade deficit counter parties are siting on ever expanding mountains of dollars, which MUST EQUAL a falling dollar rate UNTIL interest rates RISE to reach an equilibrium point against the surging dollar holdings. But as mentioned earlier the U.S. is drunk on the trade deficit policy and that of foreigners financing the US budget deficit which has the effect of gradually diminishing the reserve currency status of the U.S. Dollar which has the tendency of accelerating the trend for a falling U.S. Dollar. Now I am not talking about a collapse, what I mean is the overall multi-year trend for ever lower lows and ever lower highs.

What Does this mean for the Dollar ?

The U.S. is pumping out deficits without end of $1.5 trillion per annum, whilst at the same time lecturing the world on capitalism when in actual fact it through its actions has become the worlds biggest socialist state that does what all socialist countries do best which is to print money to finance federal and state deficits. The continuous flood of dollars is set against the exporters all fighting to devalue to hold onto the US export markets. This also suggests a slower relative rate of descent for the Dollar than should take place, if not reinforcing the trading range of USD 90-70, because as the dollar slides towards the multi-year lows so will the intensity of foreign central bank actions to force their respective currencies lower intensify. Ultimately the dollar's multi-year trading ranges are destined to take steps lower all the way to the ultimate panic stage when hyperinflation kicks in which it eventually will do as the fundamentals of the ever expanding total debt as a % of GDP suggests ever higher inflation all the way towards ultimate debt default through ever higher inflation.

Don't be lulled into a false sense of security by the ongoing false calm before the inevitable debt default storm via high inflation! After all that's what Icelanders thought before their economy and currency went POOF, that's what the Greeks thought before their interest rates suddenly more than tripled with the Germans stepping into bail them out (temporarily).

Hyperinflation ?

Given the ever expanding debt load it appears hyperinflation will be the ultimate destination. When ? Don't know, Hyperinflationary panics are akin to stock market crashes (especially in today's technology enhanced hyper-speed world), they can only be recognised at best a few days before the event though more likely a few hours before there is a panic run on the U.S. banking system as depositors panic out of dollars and into anything else, we are talking trillions of dollars dumped in perhaps a couple of hours sending the dollar into a nose bleed dive that no central bank will be able to prevent, that's how hyperinflation will start.

Again don't take this as a forecast for hyperinflation because it can't be forecast, it is a fiat currency panic event. Luckily inflation protection strategies can also protect against aspects of eventual hyperinflation. Note - I do not see any signs that suggest a Dollar hyperinflation event is imminent or likely during the next 12 months.